Four Components of Retirement Planning

While many of us diligently save each month in an employer-sponsored retirement plan such as a 401(k) or 403(b) or an IRA option such as a Traditional or ROTH, do we understand what we are saving for?

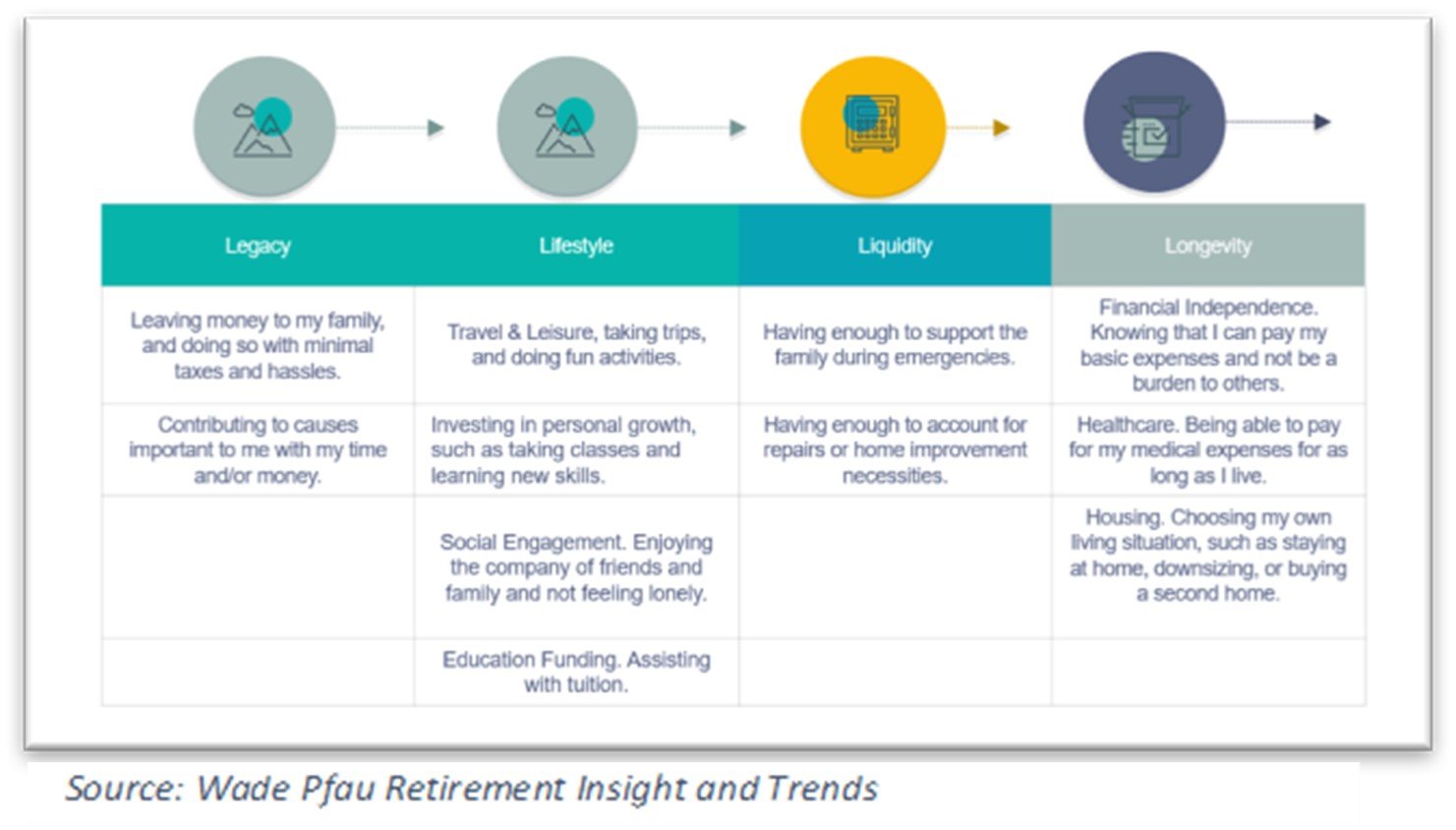

While everyone will have their unique answer to this question and personal goals, we are all likely trying to achieve four common goals within our retirement plan, which are;

- Lifestyle

- Longevity

- Legacy

- Liquidity

Let me break down precisely what I am referring to with these goals.

Lifestyle

The primary goal for most people is to maximize their spending. You want to accomplish this so that you can continue to spend at a level that affords you the lifestyle you were accustomed to during your working years. Meaning spending during retirement remains consistent and sustainable without any drastic reductions, no matter how long retirement may last.

Longevity

Longevity is likely the most fundamental risk regarding retirement planning only because no one knows how long we may live. However, to the best of our abilities, we want to ensure we have enough money to make it to the end. Here are some fascinating stats regarding life expectancies;

- A healthy male who reaches age 65 has a 50% chance of living beyond 85 and a 25% chance of living beyond 92

- A healthy female who reaches age 65 has a 50% chance of living beyond 88 and a 25% chance of living beyond 94

- A healthy couple who reaches age 65 has a 50% chance of living beyond 92 and a 25% chance of living beyond 97

A long life can be wonderful, but it can also be costly.

Legacy

The U.S. is about to undertake the most significant transfer of wealth from one generation to the next as the Baby Boomers begin to retire and make plans to leave behind their estates. For some, this is of crucial importance to them personally as grandparents want to help fund education plans and even help their children with homeownership, not to mention a variety of other philanthropic causes.

Liquidity

As we try to build emergency cash reserves as part of a balanced wealth management plan today, maintaining a sufficient reserve amount for unexpected contingencies during your retirement years is crucial. When you couple not knowing how long you may live with not knowing how your investments may perform, even the smallest of unexpected financial expenses could wreak havoc on your overall retirement plan

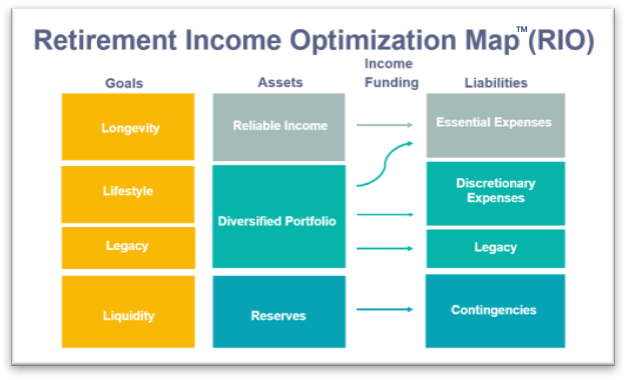

Actionable Steps & Savings Vehicles to Turn Goals into Reality

Now that you have a baseline of your goals, how do you turn those goals into reality? Below are a few actionable steps to build a retirement plan.

- Social Security: Benefits are based on the highest 35 years of earnings. Every year a person delays claiming, benefits increase by approximately 7% (delaying from age 62 to 70 results in a cumulative 76% increase). Couples should explore what their most effective claiming strategy would be.

- Pension: If eligible to receive a pension, speak to human resources about potential benefits, including if there is an option for a survivor benefit.

- 401(k) Plans (and similar workplace retirement plans): Up to $18,500 per year plus an additional $6,000 catch-up contribution for those age 50 or older can be contributed annually (based on 2018 limits). If an employer match is available, try to contribute enough to receive the match even if you cannot save the maximum $18,500 / $24,500.

- Traditional IRAs: Dollars contributed to a traditional individual retirement account can be tax-deductible if you fall within certain income levels. Mandatory withdrawals (RMDs) start at age 72 and are taxed at ordinary income rates.

- Roth IRAs: Contributions are made with after-tax dollars, but withdrawals are not taxed. Plus, no withdrawals are required for the account owner. To contribute to a ROTH, you must be under certain income thresholds.

- Health Savings Accounts: Like Roth IRAs, contributions are made with after-tax dollars, but withdrawals are not required for the account owner. Withdrawals are tax-free if used to pay for qualified medical expenses.

- Housing: Downsizing your house and moving to a less expensive area frees up cash and reduces expenses. The first $500,000 in capital gains on the sale of a married couple's home is not taxed if basic requirements are met. If you plan to stay in your existing house throughout retirement (or at least most of it), a reverse mortgage can provide a stream of income.

- Work Longer: Postponing retirement gives you more years to save, creates more time for your savings to grow, and reduces the time your savings must last. Once in retirement, working part-time can provide supplemental income even if it means that more of your Social Security benefits are taxed.

- Taxable Accounts: Money saved in bank and traditional brokerage accounts is part of your cumulative wealth. Even if you have it mentally budgeted to pay for other things, these savings should not be ignored when funding retirement expenses.

Taking The First Next Step

If you are struggling to take that first step in the retirement planning process, understand what these four goals mean to you, and review what actionable steps you can take to help get you started. Remember that the first step in building a wealth management plan is likely the hardest. However, by developing a vision of what success looks like and knowing what you want to accomplish, you can and probably will make this journey extraordinarily rewarding.

For questions about wealth planning and asset management topics, do not hesitate to contact me to find out what options may be best for your family.