How to go Beyond Traditional 401(k) Education & Advice

While some plans worry about the legal consequences of offering advice programs, the Pension Protection Act (PPA) and related DOL guidance continue to support education and advice programs. We believe that an effective plan design will provide good alternatives for participants, and effective education and advice programs will enhance the likelihood that participants will make sound designs. The result will be a reduction, not an increase in Fiduciary liability and risk of litigation.Plan sponsors retain oversights responsibility for educational and advise programs and must ensure that the advisor’s skill and methodology are consistent with “prudent” investment practice. Employers are not liable for specific investment advice delivered if the employer has met its Fiduciary responsibility.

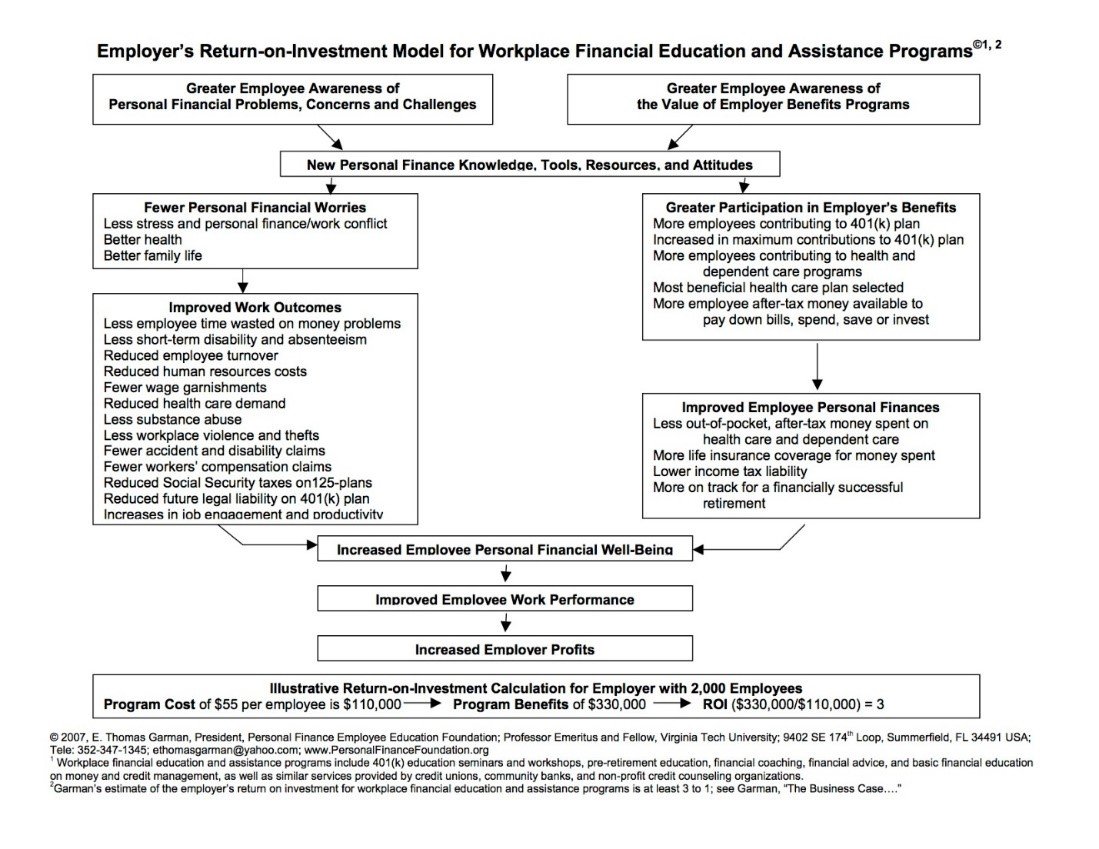

The Cost of Financial Stress

- Thomas Garman has been measuring the effects and costs associated with financial stress in the workplace for more than 20 years. Garman and colleagues estimate that the total cost of financial stress in the workplace ranges from 15% to 20% of total compensation paid, including benefits. While additional factors influence productivity, absenteeism, turnover, and healthcare costs, incorporating a financial wellness benefit to reduce the costs associated with financial stress by even 3%-5% by can improve a company’s bottom line simply through cost avoidance.

Traditional Education Programs

Traditional Education Programs

A traditional education program at enrollment should include

- Discussion on the tax and savings benefits of salary deferral contributions to the plan

- Basic investment education on diversification and investment asset classes

- Tools such as an investor’s questionnaire to help participants set their own portfolio strategy and asset allocation

- Information on investment options in the plan

Programs can be delivered in a wide range of media, including online tools and videos, webcasts, or in-person workshops. Topics can range from savings, investment, and retirement planning related to your plan’s objectives.

Beyond Traditional - Financial Employee Assistance Program

Beyond a traditional education program, TAMMA offers a unique Financial Employee Assistance Program. This program allows employees to meet one on one with a Certified Financial Planner® to discuss an array of financial planning related topics that are important to them. Additionally, we can cover specific financial planning topics in a group setting, offsite educational alternatives, provide consistent monthly email communication, and even offer an employee support helpline.Employee education and advice are just one of many Fiduciary best practices that we cover as part of our employer-sponsored retirement plan series. We designed this series to help support businesses of any size to help you reduce potential liability and provide a plan that best serves your employees.Contact us for more information about any of these best practices or to see how we may better support your company and employees with a low-cost, high service employer-sponsored retirement plan.