What is Asset Allocation and How Does It Impact Your Investments

One of the key drivers of investment performance is asset allocation. Extensive research by Vanguard has shown that 88% of your investment returns can be traced back to your asset allocation. Asset allocation is the balance between three main asset classes, equities (stocks), fixed-income (bonds), and cash and equivalents.As I laid out in the piece, Risk Perception vs. Your risk profile and subsequent asset allocation is driven by three key factors;

- Time Horizon - age and when you expect to need assets,

- Long-Term Goals & Expectations - views of how investment should perform,

- Short-Term Risk Attitudes – views towards short-term volatility.

What Are Asset Classes

The three main asset classes noted above can have varying degrees of risk and return, so each will behave differently over time. In general;

- Equities - are sought after for building a portfolio to grow with a long-term time horizon typically greater than 5 to 10 years.

- Fixed Income - can bring income and additional stability to a portfolio both in the short-term and long-term.

- Cash and equivalents – the most conservative asset class, can help reduce investment anxiety while letting you sleep at night but with the caveat of significantly reduced returns.

Asset Allocation Strategy

When building a retirement plan, your risk profile is typically assigned to three types of asset allocation strategies; conservative, moderate, or aggressive.

- Aggressive – 70% to 80% equity / 30% to 20% fixed income/cash and equivalents

- Moderate – 60% to 70% equity / 40% to 30% fixed income/cash and equivalents

- Conservative – 50% to 60% equity / 50% to 40% fixed income/cash and equivalents

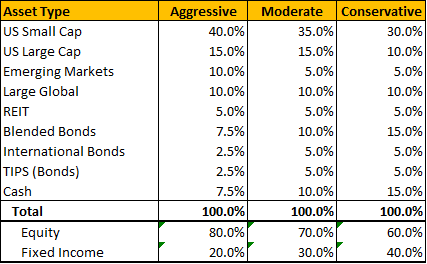

Within the asset classes of equities and fixed income, a further breakdown within those two classes can help further define the asset allocation strategy by asset type and sector. The first five asset types, US Small Cap, US Large Cap, Emerging Markets, Large Global, and REIT, are all equity asset types. Blended Bonds, International Bonds, TIPS (Bonds), and Cash are all considered fixed income asset types.Within each asset type, both equity and fixed income, these assets can have varying degrees of risk and return. It is essential to consider these asset types when building an overall asset allocation strategy and subsequent retirement portfolio and plan.Within the equity asset type classification, an additional breakdown by equity sector can be made.You can see that the total equity allocation for aggressive, moderate, and conservative align with the equity percentage in the previous table.As you can imagine, equity sector risk and returns can vary much in the same way as asset type.Below is an asset type return heat map that shows most major asset classes' returns over the past 15 years.

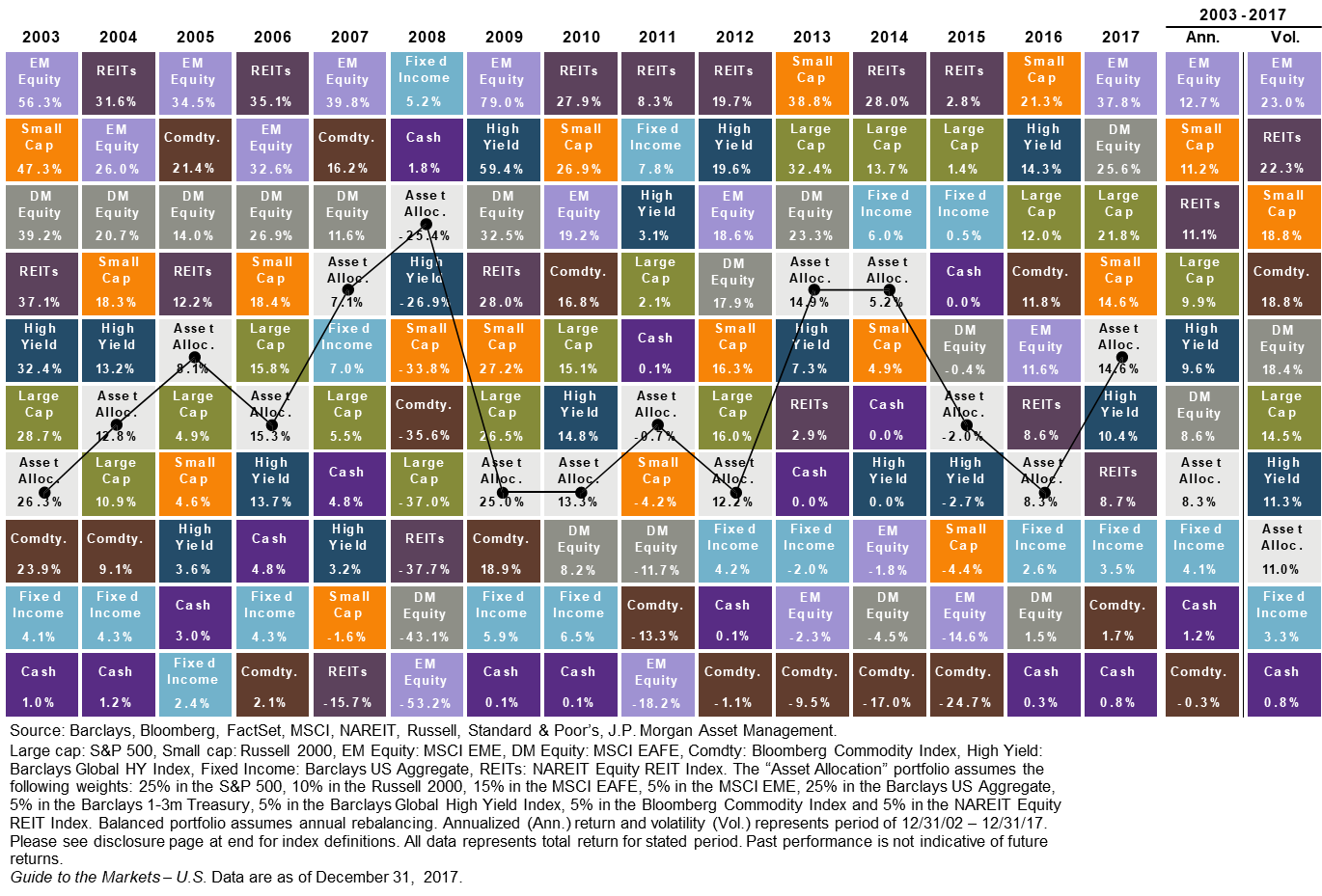

The first five asset types, US Small Cap, US Large Cap, Emerging Markets, Large Global, and REIT, are all equity asset types. Blended Bonds, International Bonds, TIPS (Bonds), and Cash are all considered fixed income asset types.Within each asset type, both equity and fixed income, these assets can have varying degrees of risk and return. It is essential to consider these asset types when building an overall asset allocation strategy and subsequent retirement portfolio and plan.Within the equity asset type classification, an additional breakdown by equity sector can be made.You can see that the total equity allocation for aggressive, moderate, and conservative align with the equity percentage in the previous table.As you can imagine, equity sector risk and returns can vary much in the same way as asset type.Below is an asset type return heat map that shows most major asset classes' returns over the past 15 years. Notice that all asset classes have had a positive return in the past two years, which has not occurred since 2009 and 2010. I would also like to highlight the performances in cash over this period. In good times, such as the last few years, cash will likely be the worst returning asset class. However, when times turn rough as they did in 2008, cash was the second-highest yielding class.Overall, I think that a picture like this can be summarized into this point, asset class returns can vary significantly from year to year, and trying to pick which ones will have the highest returns is just about impossible to predict!

Notice that all asset classes have had a positive return in the past two years, which has not occurred since 2009 and 2010. I would also like to highlight the performances in cash over this period. In good times, such as the last few years, cash will likely be the worst returning asset class. However, when times turn rough as they did in 2008, cash was the second-highest yielding class.Overall, I think that a picture like this can be summarized into this point, asset class returns can vary significantly from year to year, and trying to pick which ones will have the highest returns is just about impossible to predict!

What Is the Right Your Asset Allocation Strategy?

First, there is no simple formula that can find the right asset allocation for every individual. Second, investors may use different asset allocations for different objectives.Our primary focus thus far has been on developing an asset allocation strategy for a retirement portfolio. However, having short-term savings goals, such as buying a new house or car, would have a vastly different asset allocation than their retirement portfolio.Risk tolerance and perception also play a crucial factor, as well. Someone not comfortable investing in stocks may put his or her money in a more conservative allocation despite a long-term horizon. Recall from the asset class heat map above, a more conservative asset allocation generally leads to lower investment returns. It is critical to align your objective, whether short-term or long-term, with the right asset allocation strategy.It is not so much the individual asset class risk that matters, but rather how they all work together to create or reduce overall portfolio risk. Historical relationships and correlations are continually changing over time, so the goal should be to have several assets that will act differently than one another without becoming overly-diversified.There’s no such thing as a perfect portfolio or asset allocation strategy. The ideal allocation will only be known in hindsight. Diversification is never going to eliminate risk, but asset allocation can help you manage it.For questions about any wealth planning and asset management topics, do not hesitate to contact me to find out what options may be best for your situation.